The Nokia failure has been for years a case study for all business schools. That is the example of how overconfidence can destroy the business itself. The pride of “not invented here” is a devil in the current dynamic world where smart and motivated people can be located in a small village in small unknown Country. An apparently insignificant person has sometimes the power to disrupt the world using a internet connection. Did really Nokia case teach the business leaders about the risks of overconfidence?

I have tried to compare the Nokia approach with another big Finnish Corporate chosen by chance considering similar size, importance for the local economy and eventually analogue cultural approach. Two complete different product portofolio, but….let’s see….Minsdet is more important than business strategies sometimes. Do you agree?

| Aspect | Nokia | Wärtsilä | Similarities |

|---|---|---|---|

| Industry | Mobile phones, telecommunications | Marine engines, energy solutions | Both operated as market leaders in their respective industries. |

| Initial Market Leadership | Dominated global mobile phone market, known for reliable hardware and strong brand loyalty. | Leading provider of marine engines and power solutions, known for efficient products. | Both were highly successful, leading to overconfidence. |

| Over-reliance on Legacy Products | Overestimated continued success of feature phones, delayed shift to smartphones. | Overestimated the longevity of fossil fuel-based engines, delayed shift to renewable energy. | Believed existing products would maintain market dominance. |

| Failure to Adapt to Industry Changes | Slow to adopt touchscreen smartphones and software ecosystems (iOS, Android), clung to Symbian OS. | Slow to transition towards greener, renewable energy solutions, focused on fossil fuel engines. | Both underestimated disruptive industry changes. |

| Underestimation of Competitors | Viewed Apple’s iPhone and Android as niche products, delayed response to their growing dominance. | Underestimated the rise of renewable energy and smart technologies, and competition from new entrants in the sector. | Misjudged the strength of emerging competitors. |

| Delayed Strategic Shift | Late partnership with Microsoft and Windows Phone OS, which was too little, too late to regain market position. | Gradually shifting towards sustainability and digital solutions, but slow to adopt fully in early stages. | Both initiated changes after their core markets had already shifted. |

| Excessive Confidence in Brand | Believed that strong brand and hardware quality would sustain market leadership despite new technological trends. | Believed that established customer relationships and reliable technology would maintain market leadership. | Both believed their established brands would insulate them from disruption. |

| Failure to Recognize Ecosystem Shift | Focused on hardware instead of recognizing the importance of software ecosystems (app stores, integrated experiences). | Focused on physical products (engines) rather than shifting quickly to digital and smart systems integration. Recently doing a lot of marketing about ecosystems etc, to try to receover. | Underestimated the importance of ecosystem-driven strategies. |

| Strategic Consequences | Lost significant market share and exited the mobile phone business, focusing now on telecommunications infrastructure. | Facing increasing pressure from competition and regulatory shifts towards decarbonization, now accelerating green solutions. | Both experienced significant consequences, but at different scales. |

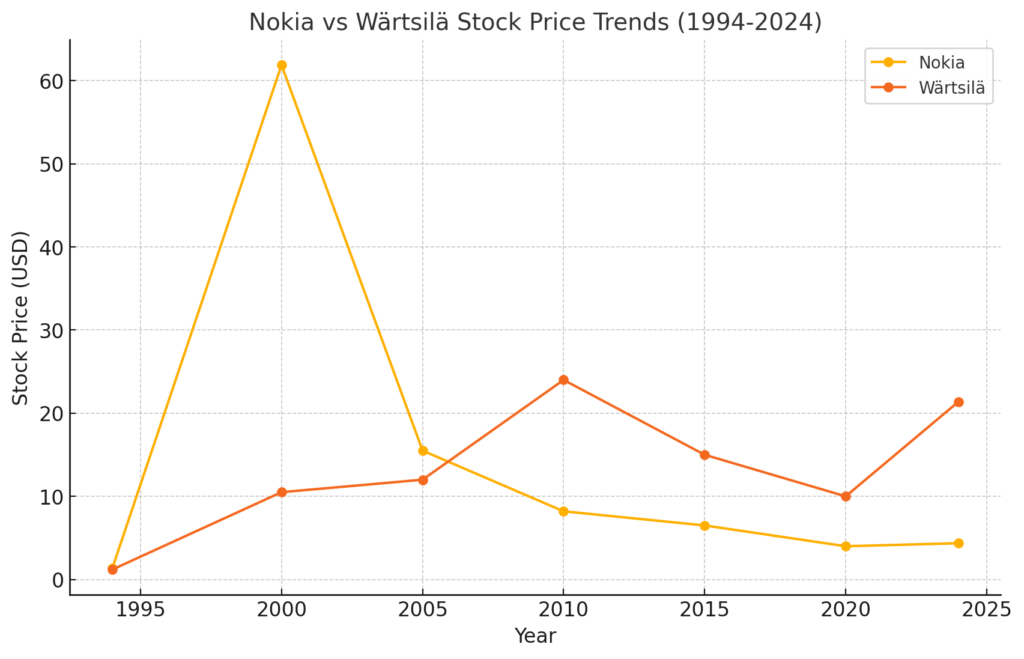

On the other hand the stock prices trend say the story is different

Nokia’s stock price peaked in 2000, followed by a steep decline, reflecting its challenges in the mobile industry. Wärtsilä, on the other hand, experienced a steadier rise, peaking around 2010-2015, before fluctuating with the transition toward sustainability, showing stronger recent performance. Recent perfomance in my opinion are connected to cost cutting, capacity costs reduction, switch from mid-long term view to short term investment and immediate return view. 10 euro (even much lower for a while) price was not sustainable for Wärtsilä company; that most probably made the investors very nervous, therefore urgent action were needed. At least they did something; the simple actions you can find in the business books. Let’s see if these basic counteractions will sustain this very complex and convoluted intenally politically -driven Company also in the future or if that last part of the currently uprising line will crash after the immediate benefis of the basic counteractions be loose their effects. Hoping for the best and wishing for the right!

Let’s see how many victims “not invented here” and overconfidence will make.